canari.dev

Canari.dev forecasts movements in equity derivatives prices

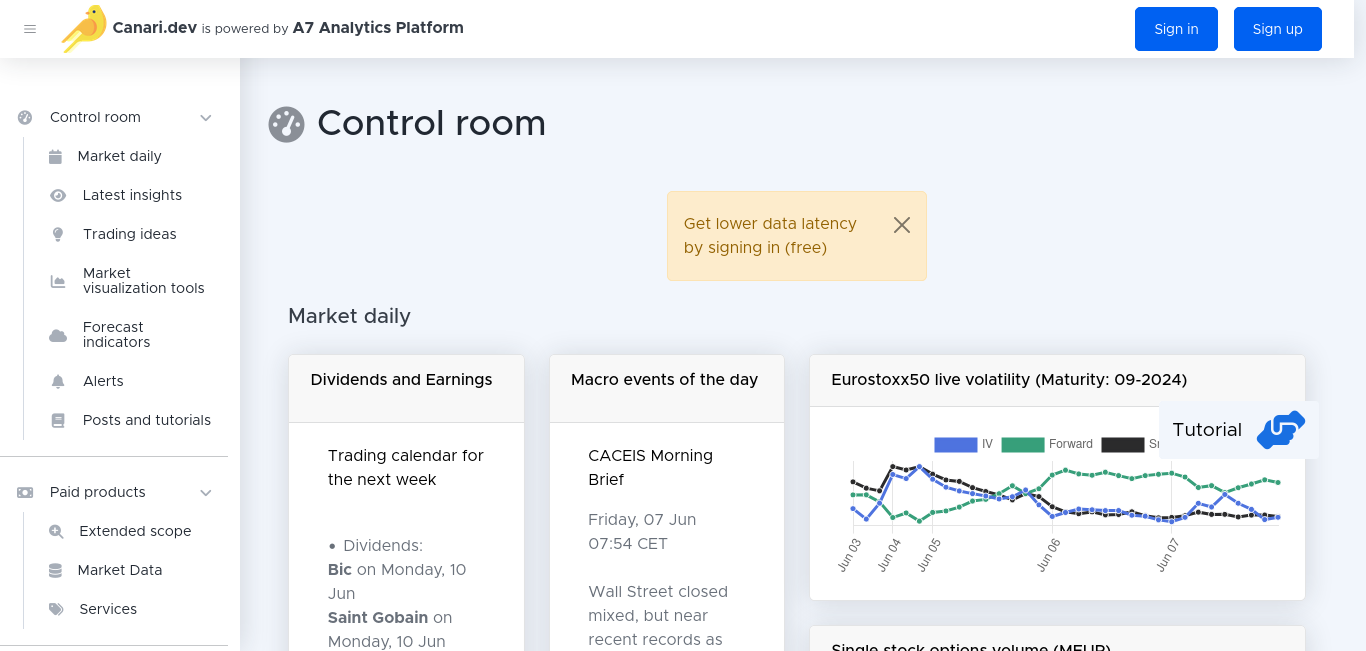

Options traders routinely compare present to past levels of Implicit Volatility (IV), sometimes relative to other underlyings. The assumption here is that the IV tends to mean revert to its moving average, or maybe that IV spread between similar underlyings will.

The same goes with the implicit versus realized volatility spreads.

And what if options are agressively bought on a maturity? Does it signal a volatility shift?

All these assumptions make sense but they are not challenged often enough.

One reason for that is the tricky nature of volatility. Are we talking about fixed strike or at the money vol? Sliding or fixed maturity?...

Another is the difficulty to stationarize data as so much depends on which volatility regime we're in.

Canari.dev does all the heavy lifting for you and provides AI generated and backtested previsional indicators on the volatility.

It also provides users with the context and specific dynamics which led to the alert being raised.